For many women, the struggle to balance work and motherhood is always a challenge. Juggling a career and family life can leave working moms feeling overwhelmed and drained, often resulting in economic stress.

While all mothers face financial hurdles, working moms are more likely to face additional strain due to the demands of their job. As the cost of living continues to rise and wages remain stagnant, this struggle has become even more daunting for many families. I have mentioned how to manage finances and financial issues in this article. To learn more, keep on reading.

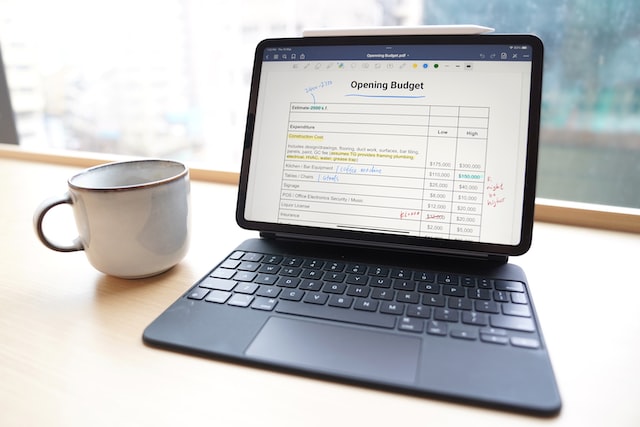

Managing Budgetary Expectations

Being a working mom is an incredibly challenging job. Not only are you managing childcare and your career, but you also must juggle the financial responsibilities of your household. It can be hard to stay on top of bills and other expenses while keeping up with the demands of motherhood, but it is possible to manage budgetary expectations and stay in control of your finances. The first step in managing budgetary expectations is to create a budget that works for you. To do this, take the time to sit down and record all income sources and fixed costs, such as rent or mortgage payments, insurance premiums, and utilities. Once these are recorded, list variable expenses like groceries or entertainment costs. It will give you an overview of how much money comes into your household each month versus how much you need to go back out to cover all necessary expenses.

Looking for Financial Support

The financial pressures that many working moms feel can be overwhelming. With the growing cost of living, it is often difficult for women who are trying to both work and raise a family to make ends meet. Fortunately, there are several resources available for moms looking for a bit of financial help. With a little research, working moms can find organizations that offer grants and scholarships tailored to their needs. They might also be eligible for loan forgiveness programs or tax credits that can help them manage their finances more effectively. For moms who have taken out a loan and find it difficult to pay it off, organizations like Go TitleLend can help them pay it off at low-interest rates with auto title loan refinance. It will help them get the support they need.

Additionally, for those seeking help managing their finances, numerous non-profit organizations and government agencies provide counseling services designed to assist individuals in budgeting and understanding credit management topics such as debt reduction and credit repair.

Making Smart Money Decisions

Are you a working mom that is struggling to make ends meet? Feeling like your financial issues are getting out of hand and there is nothing you can do about it? Do not despair; there are steps you can take to get your finances back on track. Making smart money decisions is the key to success when handling financial issues as a working mother. The first step in making smart money decisions is recognizing how much money comes in and goes out every month. Make a list of all your income sources, such as salary, bonuses, or any other type of income. Then make a list of expenses such as bills, groceries, rent or mortgage payments, childcare costs, etc. Once you have an accurate picture of what you earn and spend each month, budgeting becomes easier and more effective.

Related Posts:

- Financial Literacy That Entrepreneur Moms Should Teach Their Children

- Financial and Lifestyle Tips for the Working Mom

- Should Moms Share Financial Struggles with Children

- 5 survival tips for single moms from other single moms

- Best Home Buying Strategies For Single Working Moms