Although investing is often advised as something that is essential to growing wealth and securing your financial future, getting started with investing can seem quite complicated to anybody who is completely new to the process.

If you are just beginning to think about investing for the first time, you probably have a lot of questions to ask, such as what the best option is to invest in, when to start investing, how much to invest, and where to go for investing advice. The good news is that with investing becoming more and more popular, there is certainly no shortage of advice and answers to your questions available. And while getting started with investing can sometimes seem complicated at the start, it doesn’t have to stay that way.

If you are just beginning to think about investing for the first time, you probably have a lot of questions to ask, such as what the best option is to invest in, when to start investing, how much to invest, and where to go for investing advice. The good news is that with investing becoming more and more popular, there is certainly no shortage of advice and answers to your questions available. And while getting started with investing can sometimes seem complicated at the start, it doesn’t have to stay that way.

Whether you have just started to think about the idea of investing your money in the future or are looking to choose the right type of investment for you, keep these tips for beginners in mind to streamline the process and help yourself make the best decisions.

Start Investing Early

One of the most common mistakes that first-time investors make is waiting for too long for the perfect time to get started. However, the truth is that there is no perfect time to invest, and when you are in this mindset, there is always going to be something that comes up that makes you doubt whether investing right now is actually a good idea. The good news is that with tons of high yield bonds investment options available, it is easier than you think to find one that will work well with your current situation and circumstances that you can get started with straight away. The sooner you begin investing, the earlier you will be able to start adding to your portfolio and building your wealth.

Do Your Research

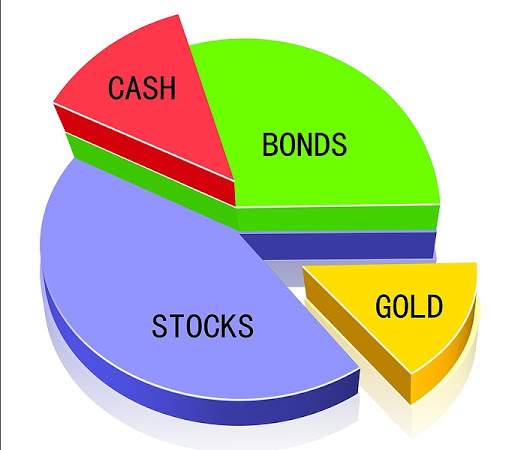

There are lots of different routes that you can take when it comes to investing your money, from stocks and bonds to cryptocurrency and trading on the Forex market, or even investing in real estate. Because of this, a lot of research to not only determine the right type of investment for you, but figure out how to do it well is crucial. It is recommended that new investors take one type of investment to start off with. Ideally, you should choose one that is relatively low-risk, suitable for beginners, and that there is a lot of information available on for you to take advantage of. One valuable tool for new investors is a smart simple stock screener, which can help you identify potential stocks that align with your investment goals and risk tolerance. By starting with a single, well-researched investment type and utilizing tools like a stock screener, you can build a strong foundation for your investment journey and gradually expand your portfolio as you gain experience and confidence.

Investing in stocks is a popular option with beginners since it is one of the most well-known types of investment around the world and there are lots of educational resources available to help you understand stocks and get started with investing in them. Purchasing stocks involves buying a share of ownership in a publicly traded company, with the aim of selling your shares when the value increases. Visit Weathsimple to learn how to buy Canadian stocks and familiarise yourself with this popular type of investment before you get started. Wealthsimple offers a lot of valuable advice on investing, buying stocks, and tools that you can use to automate and streamline your investing process.

Define Your Investment Goals

Once you have decided on the type of investments that you want to make, the first step is defining clear investment goals. Lay out your goals for the short-, medium-, and long-term, with a goal amount that you would like to hit and an ideal timeframe in which to hit it. For example, your short-term goal could be to pay off a debt this year, while a medium-term goal might be investing enough to put a down payment on a new property. A long-term goal might involve growing your retirement savings by learning how to invest 50k.

Learn how to invest for retirement because having clear investment goals to work towards makes it easier for you to continue motivating yourself to continue investing and saving, and will influence the decisions that you make for each timeframe.

Grow Your Emergency Fund

Before you start investing, it is a good idea to spend some time building an emergency fund that you can turn to for around six to nine months of your regular expenses. Having an emergency fund there if you need it offers peace of mind and helps to keep your financial risk levels low, especially if you plan to rely on investing alone for a larger number of future purchases or your retirement savings. Building an adequate emergency fund can take time, so it’s a good idea to consider any steps that you can take to speed the process up including paying off debt and minimising your monthly expenses in order to free up more money to save.

Set an Investment Budget

One of the great things about getting started with investing is that your portfolio is personal to you. You can invest as little or as much as you want in companies, currencies, cryptocurrencies, commodities and much more. With some dedication, perseverance and patience, there is the opportunity to earn a huge return on your investment. However, it’s important to avoid making the common mistake of getting too carried away with your investments. Every investment will carry a certain amount of volatility, and there is always the risk that you could lose out. Because of this, it is important to set an investment budget and only ever invest an amount of money that you are prepared and able to lose. Don’t invest money that you might need to pay expenses with. Work out your personal budget and determine how much you can comfortably afford to invest and stick to it.

Determine Your Risk Tolerance

Every investor has their own unique tolerance level when it comes to the amount of risk that they are willing to take. No matter what you decide to invest in, it is important to ensure that you only ever take on as much investment as you are able to handle when it comes to risk. Although you may be in a position to take on more risk and can afford to do so, this is not always a wise idea. Along with thinking about how much you can afford to risk, it’s also crucial to look at it from a personal perspective and think about how taking higher risks might affect your mood and stress levels. Investors who are stressed about the amount of risk that they are taking are less likely to make calculated informed decisions, and are more likely to make rash mistakes trying to reverse the situation, especially when it comes to those who are new to investing. It is always best to start off investing with a very low level of risk, and gradually build this up to a level that you are comfortable with as you learn more and gain more investing experience.

Reduce Your Costs

While you cannot get any control over how your investments are performing, how much you invest is always something that you are in control of. When first starting out with investing, it is important to pay attention to all the costs that are involved with any investment that you make. Keeping costs low is important to keep your risk levels low as you get started, helping you build your experience and knowledge level without risking huge losses.

Get Help and Advice

Investment can be complicated, so don’t think that you have to tackle it alone. There are people out there who dedicate themselves to teaching and coaching beginner investors and will be able to help you put your money to work harder for you. In addition, there are tons of online resources such as websites, blogs, apps, YouTube channels and more that are designed to help people get started with investing, make better investment decisions, and more. With investing now available to the general population and becoming more and more popular, there are more resources than ever before available to those who need some help and advice. Working with an experienced investment coach or mentor can be a very wise decision, since you will have somebody on your side to help you make the best decisions and make sense of situations that you might be struggling to understand.

Take Advantage of Automation

Once you have chosen your investments and are ready to get started, automating as much of your investing process as possible is a good idea. Today, there are tons of automated investment tools on the market and they are designed to take care of most of the process for you, allowing you to sit back, relax, and watch your wealth grow without the need to worry about making payments, transferring money, or tracking. Simple automated processes like setting up regular payments into your savings or investment account each time you are paid, along with specially designed automated investment tools that you can customise to work in the way that you want, will help your investment venture do better. The less you have to do manually when you first get started with investing, the less overwhelming everything is likely to be.

Getting started with investing is now easier than ever with so many resources and investment options available. Keep the above tips in mind as you choose the right investments for you and get to work on growing your portfolio.

Related Posts:

[…] you’d get from simply saving, but every investment carries a risk. It’s important to know the basics of investing before you hand over any money, and you shouldn’t invest money you can’t afford to […]