It’s always possible to earn extra when you’re using your card for shopping and travel. Many merchants in hotels or taxis can give you additional points if you pay with an eligible card in many countries like Norway. The additional points can depend on the location, codes, and purchases that you’ve made.

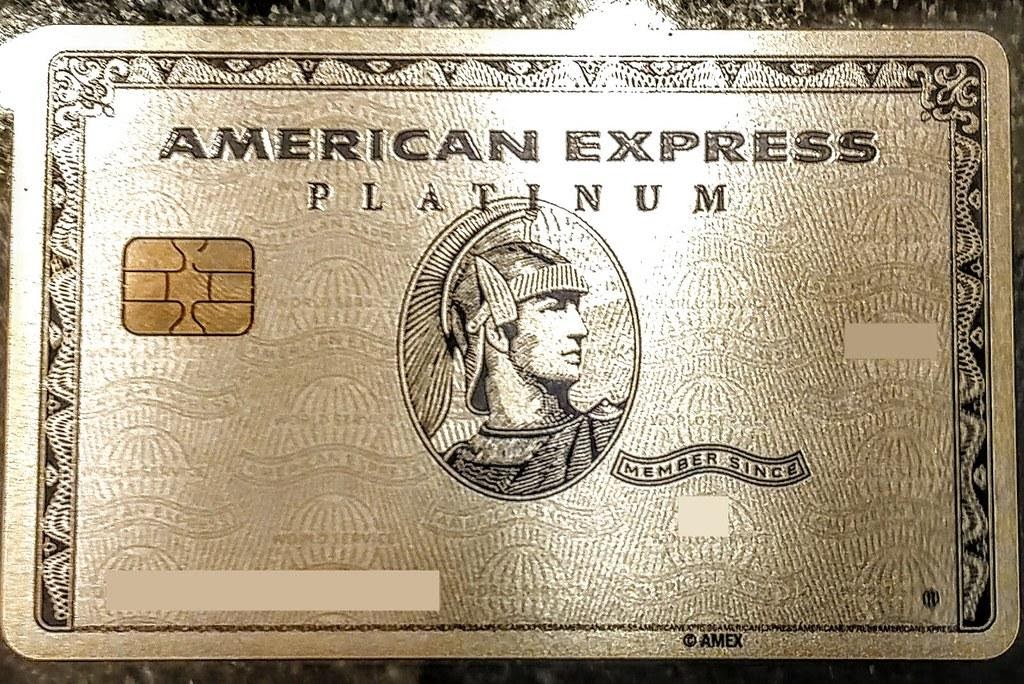

For you to earn additional rewards, using American Express from one of the companies that operate in Nordic regions is a must. You can know more about this when you click AmEx and see what your other options are when it comes to food, leisure, and cars. The extra points can be used to give you a more luxurious experience while traveling as well.

With the use of membership rewards, the points you’re earning will be worth it, which is preferable to cash. The membership tiers can vary, and there are certain eligibilities that you may need to meet before qualifying. However, if you’re a regular American Express user and other credit cards, you won’t have any problems earning these.

The rewards can vary in their worth, and they depend on the hotel or taxi corporation where you choose to redeem them. For example, you may want to use your loyalty points at a Hilton Honors Hotel because this makes them double in value versus shopping at another one with Yeti. Here are other things that you should know about them.

The Basics to Know

You may have an eligible card that you can use for your trip to Europe. The good news is that these kinds of memberships don’t require you to pay an annual fee, especially if you’ve chosen the right bank. The following will give you some points that you can use to redeem some things that you may need in the future:

- Gift Cards

- Travels

- Credits

- Points with hotels, airlines, and other associates

- Charity donations

- Shopping

- Elite clubs

The value may vary. Some may give you between 0.5 to 1 cent depending on which shop you’re redeeming them. Some will provide you with miles points whenever you travel, and other partners can even translate them into currencies in your preferred country.

Getting the Rewards

Know that lots of cards can give you the membership rewards you may be aiming for, but here are some of the popular ones that many customers use.

- Everyday credit cards can give you at least 2 points for every euro you spend on groceries. This can be capped every year, so it’s best if you ask your provider about this.

- Eligible purchases give you the right to earn a point for every euro spent

- Restaurants can give you discounts if you have accumulated enough points

- Transit and other travel bookings can give you miles in airlines

Benefits to Know About

If you plan to take advantage of the offerings to the fullest, you can even offset some of the fees associated with the card. The main thing that you need to look forward to is elevated dining, which means that you get to eat a country’s specialty without breaking your bank account.

You can get healthier snacks, delicious portions in hotel restaurants, and other perks that you may rarely get when paying in cash. Some of the benefits that you may want to think about are:

- Rewards of Supermarkets, Dining, and Travel

You can get points with your American Express just for dining, which can be applied not only in Europe but also around the world. Learn more about the American Express when you click here. You can take advantage of this even if you take out your steak for dinner.

- Supermarket purchases will give you rewards, and you can use these to your advantage.

- Book that summer vacation that you want in Norway with airlines that accept your mode of payment.

- Welcome Offers

The offers can vary when it comes to welcoming members. However, the point is that you are eligible to get over 50,000 after spending a specific amount. These can be reflected once again on eligible purchases, which can be subjected to terms and conditions. If you’re a new user and obtained your American Express less than six months ago, you can check with your provider for the current perks they are offering.

- Easier and More Flexible Redemptions

With the redemptions, you can give gifts, donate to charities, earn discounts, and more with online shops and restaurants. You can even decide to transfer the points if it makes your holiday more convenient, and you can get the most of their value with the hotel partners. The loyalty programs are not limited to a single resort or hotel, and you can change venues when you’re in a different country without any problems.

- Dining Credits

With the statement credits that you can get with both hands, the rewards seemed never-ending. All you have to do is use your card when paying, which is even second-nature to most people. Some of the best restaurants to try are steak houses, cheese factories, burger shacks, and more. Terms and conditions apply, but when you’re always dining out for business, this is an excellent opportunity to use those points.

- Convert into Cash with Eligible Transportations

The good news is that you can use the points for transport so that you’ll never get lost in Europe. You can receive cash back and even more discounts when there are promotions and deals that you’ll never want to miss. The rides are very convenient, especially if you plan to see picturesque locations and don’t want to do car rentals. In some instances, you can even roll over the points to the next month if you don’t use them.

- Resort Credits

If you’re staying at a perfect beach with swimming pools, you may want to take advantage of fine dining as well when utilizing resort credits. Some hotels can give you more than 100 credits from the hotel even if you spend just two nights with them. Have a relaxing afternoon at the spa, dine with fresh seafood or steak, and don’t miss all the activities that you can get from the resort.

- Insurance Plans

When you pay using your card, you can get insurance in case of collision damages in rental cars. Some waivers are covered, especially if you’re an eligible member, and stolen ones will activate personal auto insurance. There’s even a baggage insurance plan that can cover more than a thousand euros if you apply with the right company.

All of the figures and perks mentioned are not fixed, and some may choose specific hotels and travel agencies where you can use your loyalty cards. It’s best to ask a few questions when getting it and call customer service for more information before using it.

More Credit Card Tips

How Do Virtual Debit Cards for Kids Work?