The current scenario has troubled investors, but it is a great opportunity for investments since the market is at an all-time low.

When the stocks are down, you can buy more for less. Rest assured, when the market climbs back to good prices, you can sell those units and make the highest profits. That holds true for investments made in stocks and mutual funds. However, for precious metals, it is quite the opposite. You would have noticed that precious metals have been at an all-time high. This happens every time the market crashes, gold comes in to save the day for the investors. For this reason, gold has been a top asset most people like to secure. However, as is the case with every investment tool in the world, precious metals come with some risks attached, but there is good news!

You can see those risks well in advance, moreover, they can be avoided too. So, to help you avoid risks with investments, we are listing down some of the biggest threats for investors.

They are:

Market Fluctuations

A stock market is a volatile place with a tendency of being influenced easily by any drastic global or domestic event. A war between the USA and Iran would cause fluctuations, and so would a peace treaty between two already fighting nations. Since every major account, be it social or political has a huge say on the way the market behaves, there is always an unpredictable ethos to stocks.

If you’re looking for a cost-effective stock app where you can buy and sell stocks, ETFs, and cryptocurrencies without paying a single cent in commission (with no monthly or annual fees), check out this etoro app review.

Wrong Diversification

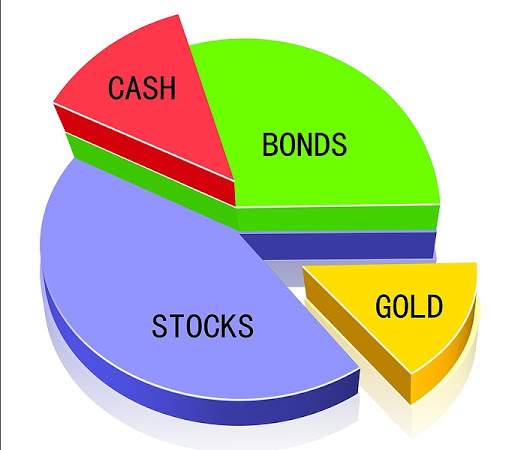

Ace investors suggest you diversify your investments to ride out the uneven tides and cycles of the market. Mostly, people think debt instruments would help them balance the risk attached with ‘high-potential growth’ tools such as equities. However, allocating too much to debt funds would not grow your finances, it may even do the opposite. Debt assets may offer more stability, but they don’t offer good returns and they are also prone to market fluctuations.

Choosing the Wrong Metals

A lot of beginners look towards precious metals to diversify their portfolio without concrete knowledge of how to do it right. That’s not a great decision! Depending upon what your financial goals are, your decision should also vary. For instance, those who seek high returns should not purchase Palladium/Zinc. These metals do perform but fluctuate frequently.

They can land you in negative. Platinum is more stable than silver and can give unbelievable outputs too, however, gold is the safest bet. Gold is consistently appreciating for the last few years. To buy precious metals, you should consider certified portals like Auctus Metals.

Buying Gold but Not Real Gold

You may feel buying gold bonds or ETFs is rather convenient, however, when the mining company whose bonds you bought declines, your portfolio goes down with them., regardless of how is gold doing at that point. Thus, buying gold in its original physical state in the form of coins, bullion, or bars makes the best sense.

Buying Gold but Not Real Gold

No, we aren’t repeating the same point! You can be duped and sold inferior gold for the price of pure gold or more superior gold. This can lead to a mismatched calculation, prominent losses, and severe helplessness when you need to sell your gold for some need. Thus, you should only go to verified precious metal dealers when you are looking to buy precious metals like Gold, Silver, and Platinum.

We hope this article has encouraged you to make better decisions when it comes to your finances. Have a good luck!

More Investing Advice

Hello!

Investors suggest you diversify your investments to ride out the uneven tides and cycles of the market. This can lead to a mismatched calculation, prominent losses, and severe helplessness when we need to sell your gold for some need. we aren’t repeating the same point! You can be duped and sold inferior gold for the price of pure gold or more superior gold.

Private equity software