Investing in stocks can be an effective way to grow your money over time. However, for beginners, knowing where to start can be overwhelming. Here is a guide to the stock market basics to help you get started with investing.

What are Stocks?

Stocks, also known as equities or shares, represent part ownership in a company. When you purchase a company’s shares, you become a shareholder. Shares entitle shareholders to partake in the company’s profits and growth through share price appreciation and dividends.

How the Stock Market Works

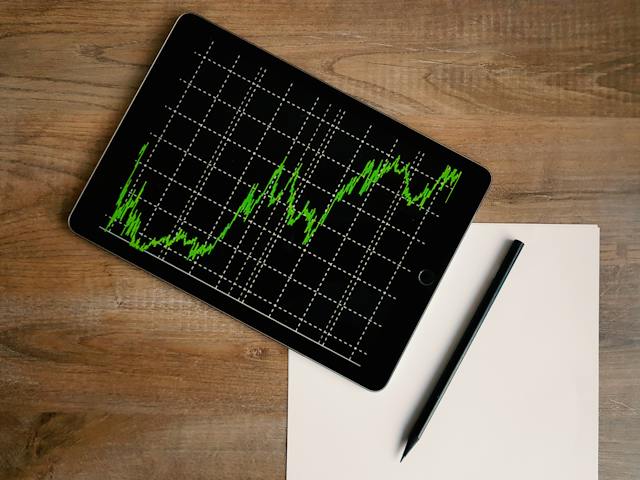

Stocks are traded on stock exchanges like the New York Stock Exchange (NYSE) and NASDAQ. The stock prices you see fluctuating constantly represent the market value of the shares. This value is based on supply, demand, as well as investors’ emotions and expectations about a company’s future performance.

Deciding Where to Invest

As a beginner, sticking to established, reputable companies is usually the safest bet. These large market cap companies, such as Apple and Microsoft, or Johnson & Johnson, tend to have steady stock prices and regular modest dividend payments. You can further diversify your portfolio by investing across market sectors.

Note that Penny Stocks, while inexpensive, are highly speculative securities that are often offered by smaller companies. While penny stocks may prospectively yield huge returns, they also tend to be extremely risky investments due to lack of regulation and financial reporting requirements. For beginner investors, it’s generally advisable to avoid these volatile penny stocks entirely until you gain more trading experience and knowledge.

Researching Companies to Invest in

Before purchasing shares, it’s important to research companies thoroughly. Analyze financial statements, products and services, management team’s experience, as well as recent news and industry trends. Getting a sense of the company’s overall health and potential for future growth will help inform your decisions. Pay attention to price-to-earnings ratios, earnings per share, profit margins, and revenue growth when comparing potential investments.

Using an Online Brokerage

One of the most convenient ways to trade stocks is through an online brokerage firm. Brokerages enable you to buy and sell stocks, usually for a flat per-trade commission fee. Most brokers also provide research tools, educational resources, and investment guidance to help you manage your portfolio.

Types of Stock Trades

There are two main ways to approach stock trading. Investing means buying shares to hold for the long term, while anticipating steady value appreciation over years. Speculating or trading, on the other hand, involves attempting to profit from short-term price movements.

Managing Risk

Don’t put all your money into one or two investments. Spreading your capital across at least 10-15 stocks across industries can help mitigate risk. This diversification will help ensure that the poor performance of one stock doesn’t tank your entire portfolio. Also, set stop losses to automatically sell shares if they fall below a pre-determined price. Consider dollar cost averaging by making equal investments at regular intervals to smooth out market volatility.

Stock Options for Beginners

When first getting started, it can be wise to practice trading techniques using stock market simulators before risking real capital. Virtual trading platforms like Investopedia’s Stock Simulator allow you to practice buying and selling stocks in real-time with fake money. This allows you to gain experience before putting your funds on the line.

Getting Comfortable with Investing

Learning to invest in stocks takes time, research, patience, and developing an understanding of your goals and risk tolerance. Don’t get discouraged by short-term losses. Ups and downs are part of the process. Stick to fundamentals, focus on long-term goals, and keep learning along the way. Joining an investment club or stock market forum can provide community support as you build your knowledge.